![]() Bitcoin is no longer insignificant.

Bitcoin is no longer insignificant.

Initially derided by most as a gimmick, the current market value of all bitcoins in circulation is estimated at nearly $10 billion USD.1

Market Capitalization from BlockChain.info

On Friday, November 29th, 2013, the value of a single bitcoin peaked at $1137. To put this in perspective, one bitcoin could have been purchased a year ago for roughly $13.

Critics argue that the price indicates a bubble. Enthusiasts would suggest that bitcoins are still undervalued even at current rates. Whichever the case, the price subsequently dropped from November’s all-time high, but is currently hovering around $730 USD per bitcion.

Coinbase.com Bitcoin valuations.

This substantial increase in market valuation has been driven by interest from both speculators, and 3rd parties making use of Bitcoin as an innovative, decentralized, and technically secure (thus far) medium of exchange.

Released to the world in 2009 as the mysterious creation of a (presumably) pseudonymous developer known as ”Satoshi Nakamoto,” Bitcoin initially gained traction from enthusiasts as a successful iteration of previous attempts at cryptocurrencies, because it managed to resolve a few fundamental issues surrounding “cryptocurrencies” (digital currencies), including double-spending,2 and decentralization. Additionally, unlike traditional currencies, the currency is deflationary by nature, since theoretically only 21 million bitcoins will ever be created.

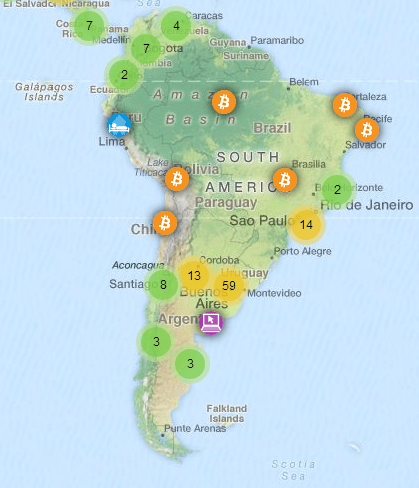

Bitcoins (BTC) are currently accepted at a range of establishments, including WordPress.com, OKCupid, over 13,000 restaurants in 3,150 cities listed via Foodler, and a fully functioning Bitcoin ATM was set up in Vancuver, Canada, in 2013. Coinmap maintains a global database of establishments which accept bitcoins.

Adam Stradling, Founder at Coin4ce.com, which he described as a Chile-based Bitcoin company supporting customers in Chile and Mexico, notes that while the Bitcoin ecosystem in Latin America is currently lagging behind the United States, he notes that “liquidity is a large piece of the ecosystem, and buying and trading Bitcoins is currently much harder to do in LatAm than in the USA.” Adam says that while there are now thousands of merchants accepting Bitcoins in the USA, there are only a few in Chile.3

Coinmap: Data © by OpenStreetMap contributors.

Tomas Alvarez, CEO of Coincove, opined to InsightSur that, “Bitcoin is thriving in the US due to its novelty factor (lots of willing early adopters), ideological factor (economic freedom, libertarianism, etc), and the investment culture (wall street) that heavily permeates this country.” He added that for Latin Americans, “the allure of Bitcoin mainly rests on its potential to protect us from governments that mismanage their economies (often resulting in currency debasement), a situation to which no Latin American is a stranger.”

It is clear that certain areas of Latin America have more incentive than others to adopt a decentralized and secure currency due to instability, and political meddling.

At the same time, potential users in Latin America face technological and infrastructure barriers. According to an article published by Rachel Glickhouse for Americas Society / Council of the Americas (AS/COA), only 43% of the population of Latin America and the Caribbean are internet users, with Argentina representing the region’s highest internet penetration rate at 68%.

In addition to technological and infrastructure barriers in Latin America, internet users in the region face governmental restrictions. According to the 2013 Freedom on the Net ranking by Freedom House, Mexico, Brazil, Ecuador, and Venezuela received grades of “partially free,” while Cuba received the worst grade possible and was designated, “not free.” Additionally, the free market principles embedded in the digital currency, may clash with areas of Latin America where governments have recently had a heavier hand.

Those are not encouraging developments for a monetary system dependent on technology. Yet, that same political turmoil could be a force that drives further adoption by individuals looking for a secure and easily transferable alternative to the United States dollar, which has a history as a popular reserve currency in Latin America as a hedge against inflation, but has become more restricted recently, especially in Venezuela and Argentina. The United States dollar is actually used as the official currency in more than one country in Latin America for this very reason.

VentureBeat reported that 30% of Brazilians surveyed had heard of Bitcoin, and only 16% of Mexicans had heard of the digital currency, according to a study performed by Jana, a mobile platform connecting brands with emerging market consumers.

Rodrigo Batista, CEO of Mercado Bitcoin, notes that Brazil, Latin America’s largest economy, is unsurprisingly the most mature Bitcoin market in Latin America, adding that his exchange is currently trading around $5 million in bitcoins every month, but he notes that Brazil is still lagging the United States in physical stores accepting bitcoins. Rodrigo said he is optimistic that many stores will start accepting bitcoins and other virtual currencies as a payment alternative in Brazil during 2014.

Adam Stradling notes that while challenges in liquidity remain in Latin America, “companies are starting to emerge to connect LatAm to the global ecosystem.”

One area that may drive growth and support of Bitcoin in Latin America, is its potential for use in remittances. According to a 2011 report by the Multilateral Investment Fund (MIF), fully $61 billion USD were sent to the region during the year of the study, with Brazil accounting for $1.9 billion, and Mexico with the lion’s share at $22 billion dollars.

According to that same report, average remittance fees to transfer funds to the region are between 5% and 6% of funds transferred. Western Union, one of the largest providers of money wires and fund transfers globally, charges roughly $7 USD to send $100 USD according to data compiled by The World Bank, compared to Bitcoin fees of between $0.08, and $3 USD per transaction (regardless of the amount being sent).

Western Union alone saw over $5 billion in revenue in 2010; roughly half of Bitcoin’s current market cap of $10 billion.

However, if Bitcoin grows as a tool for remittances, it is likely to come under increased scrutiny from a myriad of international monetary agencies.

Rodrigo Batista, says that Brazilian regulators have not yet started talking publicly about digital currencies, and speculates that he main reason for this, is that the Bitcoin market in Brazil is still relatively small.

“I expect that some conversations will start next year, but we don’t foresee any major change in the current status of ‘no regulation at all,'” said Rodrigo.

Michael Nielsen, author of Reinventing Discovery: the New Era of Networked Science, notes that, despite critics of Bitcoin who point to its use in illicit activities such as Silk Road, Bitcoin’s publicly view-able ledger of transactions actually makes it more transparent than cash, and more traceable than many realize, adding that he would be, “extremely surprised if the great majority of Bitcoin users are not identified with relatively high confidence and ease in the near future.”

Adam Stradling, told InsightSur that while the general consensus is that, while the United States government is wary of Bitcoin, and will be keeping a close watch on the urgency from a regulatory perspective, “they recognize the innovation and potential value in the system and do not want to put clamps on it.” Importantly, Adam notes that while many other countries are also beginning to lay out their own regulation guidelines, no countries in Latin America have put out any official guidance yet.

The Bitcoin network has work to do on infrastructure and education to support further acceptance in Latin America, but Bitcoin is clearly an emerging technology with extraordinary potential for unique challenges in Latin America, from remittances to protection against erratic monetary policies, and as 2014 begins, Latin America may be the region to watch if Bitcoin succeeds.

1. [$9,800,000,000 was the total number of bitcoins in circulation on 1/1/14 according to Blockchain.info.] ↩ Back to Article

2. [“Double-spending” is a flaw that allows the same digital token to be spent twice, since there is no physical coin, and digital files can easily be duplicated.] ↩ Back to Article

3. [Adam noted that next week, “California Cantina” in Santiago, will become the first Restaurant in Chile and first nightclub in LatAm to accept Bitcoins.] ↩ Back to Article

Hmmm.

A Spanish language version of this article is available at The PanAm Post:

http://esblog.panampost.com/joel-fensch/2014/01/02/bitcoin-se-prepara-para-el-despegue-en-america-latina

Thanks for the anonymous tip today! Appreciated.